The “Technical Analysis For Successful Trading” program is designed to provide comprehensive insights into technical analysis techniques and strategies, tailored specifically for trading in stocks, futures, and commodities. The primary goal of this course is to equip investors and traders with the knowledge and skills necessary to trade proficiently and generate consistent profits.

Whether you are a novice in trading or have some experience, this course is structured to impart both fundamental principles and advanced strategies essential for success in active trading. Through a blend of theoretical learning and practical application, participants will gain proficiency in technical analysis, risk assessment, psychological aspects of trading, and the analysis of real-world case studies.

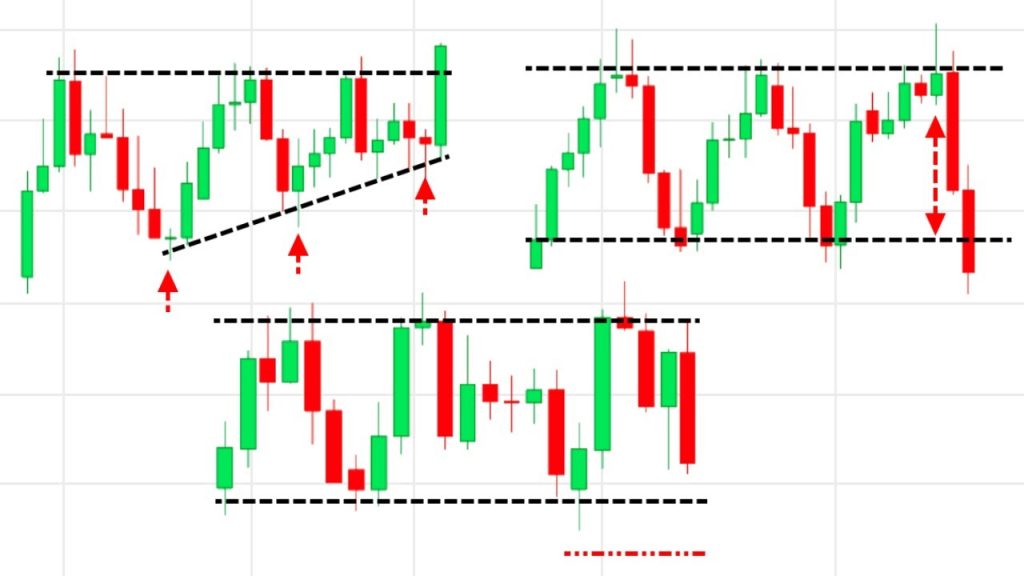

The curriculum covers technical analysis concepts from the foundational level to the most intricate strategies employed by seasoned traders and market experts. Participants will learn to identify high-probability chart patterns and other key indicators across various time frames. Furthermore, the course will focus on teaching participants how to effectively interpret this data to make informed decisions on trade entry, management, and exit strategies.

By the end of the program, participants will have acquired a comprehensive understanding of technical analysis principles and their practical application in the dynamic world of trading. They will be empowered with the skills necessary to navigate market trends, capitalize on trading opportunities, and manage risk effectively.

Our Comprehensive Technical Analysis Course offers a comprehensive curriculum covering essential topics, advanced techniques, and practical strategies to help you become a proficient and successful trader. Whether you’re a beginner or an experienced trader, this course provides the knowledge, skills, and confidence you need to navigate financial markets with precision and profitability. Join us today and embark on your journey towards trading mastery!

+91 91473 70500